Fall 2025 Real Estate Forecast: Answering the 7 Most-Searched Questions on Rates, Affordability, and Market Timing

The Fall 2025 real estate market is characterized by a significant period of transition. The relentless seller’s frenzy that defined the market over the past few years is giving way to a more balanced, rational environment. While the sales velocity has cooled, slowing home price growth and normalizing listing prices are creating a steady market where the dynamics between buyers and sellers are equalizing. This period is not defined by a market crash, but rather a necessary stabilization.

What Are the True Hidden Costs of Buying in NYC? A 2025 Expert Guide to Taxes, Fees, and Carrying Expenses

Buying real estate in New York City is famously complex, characterized by unique statutory requirements and fees that often blindside even financially sophisticated buyers. While the down payment and mortgage principal capture most of the initial attention, the true barrier to entry often lies in the volume and progressive nature of the secondary expenses—the hidden costs.

These additional costs are formally categorized as "closing costs,"

How Competitive is the Market, and What's the Best Strategy for Making an Offer?

New York's housing market is uniquely defined by proximity. Seasonal Swings, Socioeconomic Strata, Evergreen Hotspots, Inventory Fluctuation and the propensity to find a unicorn in the market are major factors in answering the questions: How Competitive is the Market, and What's the Best Strategy for Making an Offer?

How Do I Navigate the Mortgage and Financing Process in NYC?

Navigating the mortgage and financing process in New York City can feel like a labyrinth, even for seasoned buyers. The city's unique real estate market, particularly its prevalence of co-op apartments, introduces specific challenges that differ significantly from other housing markets. Understanding these nuances and preparing accordingly is key to a smooth and successful home-buying journey.

Your Life On Paper (What is The Co-operative/Co-op Board Application)

Buying a co-op is unlike any other real estate purchase. It’s not just about the numbers or the space; it’s about a deeply personal journey where you quite literally lay your life out on paper for a cooperative board to evaluate. This is why I call the application process, “Your Life On Paper.” Financial Health: You must provide tax returns, often for the past three years, along with proof of all bank and investment accounts, sometimes covering the past three months. This includes information on all outstanding debt, liabilities, and assets.

Credit and Background: The board will have access to your credit history and will conduct a criminal background check. They need assurance that you are financially responsible and will be a good fiduciary steward of the cooperative.

Purchase History: Documentation of the purchase of your current home is often required.

Personal and Professional Ties: You must provide extensive references—often one professional, two personal, and one or two financial. This gives them a view of your key relationships, your stability, and your character as seen by others. You may also need to list your recreational interests, club memberships, and affiliations.

Signed Commitments: The application includes signing multiple affidavits and agreements. You will sign an affidavit concerning your financial health, sign waivers, and formally commit to honoring the building's House Rules. Furthermore, you must commit to full disclosure regarding any current or future renovation plans.

Navigating the NYC Apartment Maze: Condos vs. Co-ops with Seth Beverly III (Part 3: Market Dynamics & Your Next Move)

For those looking to buy or sell an apartment here, the terms "condo" and "co-op" are omnipresent, yet their distinctions often remain a mystery. As your dedicated associate real estate broker, Seth Beverly III, I'm here to demystify these crucial differences and guide you through the intricacies of the NYC market. Understanding whether you're buying into a co-operative or a condominium isn't just about legal jargon; it's about lifestyle, financial implications, and ultimately, your homeownership experience.

In this multi-part series, we'll explore what defines these two popular forms of apartment ownership, delve into their unique histories, dissect their operational structures, analyze market trends, and highlight the practical considerations for buyers and sellers alike.

Navigating the NYC Apartment Maze: Condos vs. Co-ops with Seth Beverly III (Part 2: The Condo Experience & Practical Differences)

We'll focus on the condominium, a more conventional form of ownership, and then put both condos and co-operatives side-by-side to highlight the practical differences that truly matter to shareholders, buyers and sellers.

Image represents the code applicants must crack to gain approval. Ico-op board approval, co-op application tips, what co-op boards look for, and understanding co-op requirements.

Navigating the NYC Apartment Maze: Condos vs. Co-ops with Seth Beverly III (Part 1: The Co-op Story)

Navigating the NYC Apartment Maze: Condos vs. Co-ops with Seth Beverly III

Explore what defines these two popular forms of apartment ownership, delve into their unique histories, dissect their operational structures, analyze market trends, and highlight the practical considerations for buyers and sellers alike.

co-op vs condo differences, buying a co-op, condo ownership guide, and real estate decision making.

What should I be asking about the building's financials and history?

In a city of towering co-ops and sprawling condo buildings, you're not just buying a single unit; you're buying into a collective (sometimes a literal corporation). The financial and physical health of that building will directly impact your quality of life, your wallet, and your long-term investment.

Beyond the beautiful finishes and a great view, what should you be asking about a building's financials and history? Here’s a guide to help you dig deeper and make a truly informed decision.

What Does The SALT Cap Increase Mean For My Taxes?

What Does The SALT Cap Increase Mean For My Taxes?

As a New York homeowner, the recent changes to the State and Local Tax (SALT) deduction cap, as part of the "One Big Beautiful Bill Act," can significantly impact your tax situation.1 Here's an explanation of the changes and some practical actions you can take.

***This is not tax, financial or legal advice. Consult a tax accountant to ensure that your financial obligations are met and properly handled. The purpose of this article is to share opinions based on limited knowledge and research about a topic that should be of interest to my consumer base.

The New SALT Cap and How It Affects You

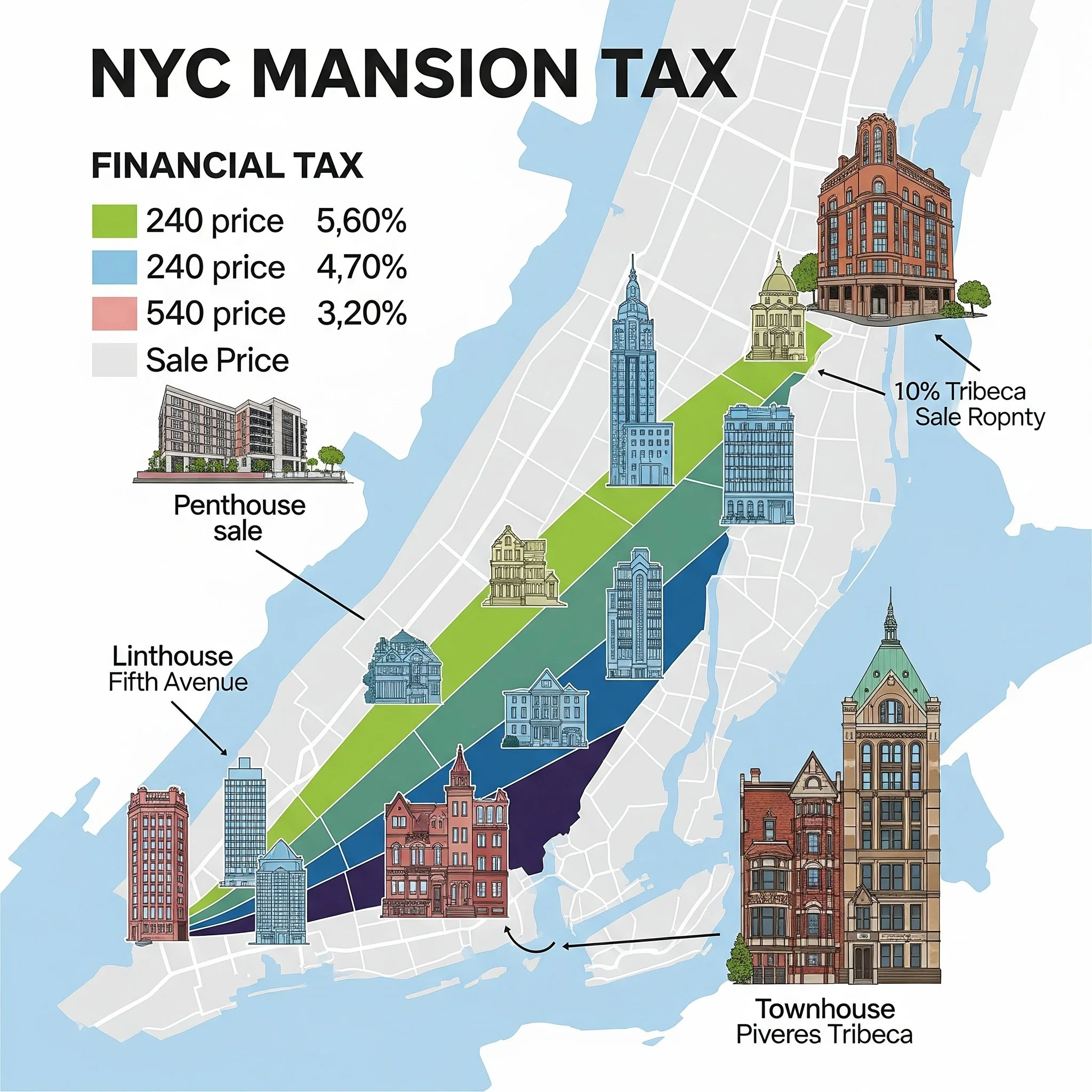

What Is The NYC Mansion Tax

The NYC Mansion Tax is a real estate transfer tax levied on the purchase of residential properties within New York City that sell for…

The current tiered system for the NYC Mansion Tax, applicable to residential purchases of $1 million or more, is as follows:

1.50% for purchases from $3,000,000 to $4,999,999

3.75% for purchases from $20,000,000 to $24,999,999

3.90% for purchases of $25,000,000 or greater

Marketing Your Home

Effective marketing is key to reaching the widest pool of potential buyers. I utilize a multi-faceted approach:

I'll ensure your home receives maximum exposure to qualified buyers, both locally and beyond.

Marketing Your Home: Staging

For in-person staging, the goal is to optimize the home's appearance through decluttering, repairs, and strategic furniture placement to enhance its appeal.

Both methods align with my philosophy of "honest photography" to convert web traffic into offers. Whether through technologically advanced virtual transformations or meticulous in-person arrangements, my masterful use of staging ensures that prospective buyers feel a confirmed experience when they arrive, building trust and strengthening negotiations.